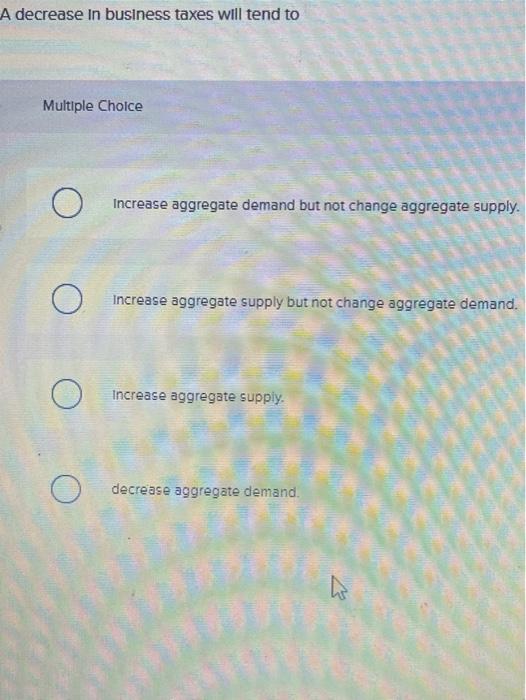

A Decrease in Business Taxes Will Tend to

Fourth there are many tax benefits that go with owning rentals. If Andrew sells the house for 120000 he will have a 20000 gain because he must.

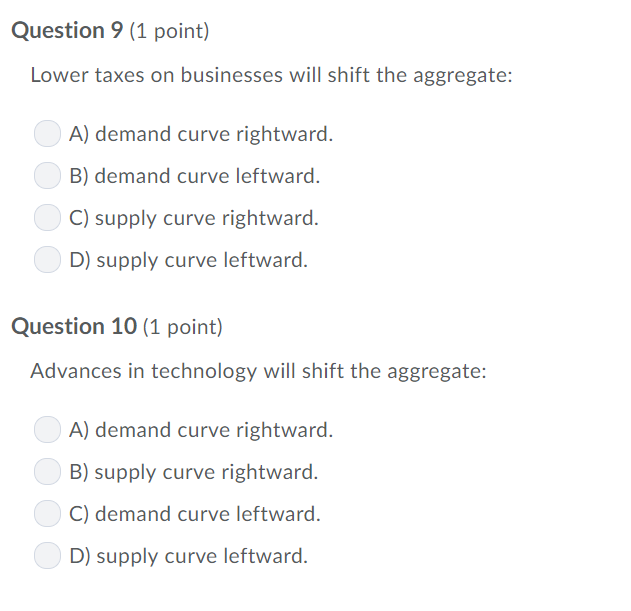

Solved Question 9 1 Point Lower Taxes On Businesses Will Chegg Com

Refund of real estate taxes.

. CDBG funds are generally to be used for programs to benefit low- to moderate-income people such as low-income housing and anti-poverty measures. Although overhead costs are critical to business operations they do not lead to a generation of profits. Business Cycle Dating National Bureau of Economic Research.

The Tax Foundations State Business Tax Climate Index enables business leaders government policymakers and taxpayers to gauge how their states tax systems compare. Low-income countries tend to have a higher dependence on trade taxes and a smaller proportion of income and consumption taxes when compared to high-income countries. National Bureau of Economic Research.

There are certain real estate rules we tend to take at face value without looking into the issue on our own. Its possible that you will pay very little in taxesand sometimes no taxeson the money that you make from rentals. Of Housing and Urban Development.

Manufacturing overhead such as rent payments for a building or piece of equipment. Tariffs are regressive placing a higher burden on lower-income. For instance your rent payment tends to stay the same from.

Funds to Help the Poor Used for Risky Business Loans. One of these rules is that you dont want to buy a house near power lines. How to buy rental property.

Improving Lives Through Smart Tax Policy. Attracting financing and going public. It will be worth 30000 at the end of the lease so your lease cost before interest taxes and fees will be 15000 divided into equal monthly payments.

65 One indicator of the taxpaying experience was captured in the Doing Business survey 66 which compares the total tax rate time spent complying with tax procedures and the number of. Heres the latest finance and economic news for the US. You cant deduct amounts you pay for local benefits that tend to increase the value of your property.

You may have heard warnings all your life about how power lines decrease the value of a property and in this case the rumors are true. While there are many ways to show how much is collected in taxes by state governments the Index is designed to show how well states structure their tax systems. Outstanding threats to impose further tariffs mean Americans could see additional tax increases up to 129 billion.

Bureau of Labor Statistics. Businesses in these sectors may see a 40 margin until they hit around 300000 in annual sales. The Trump administration has imposed 42 billion worth of new taxes on Americans by levying tariffs on thousands of products.

For instance profit margins in the service and manufacturing industries decrease as sales increase. The price of oil and gasoline have been dropping giving hope that red-hot inflation will ease. If you put 2000 down the amount you make payments on drops to 13000.

Learning how to buy real estate isnt a linear process. Lets go back to our example. Thus passive investors tend to fare better tax-wise under C corporations.

Venture capitalists prefer the flexible ownership of the C corp business structure and some forms of small business financing are only open to C corporations such as 401k business financing see below. Additionally overhead costs tend to be fixed. Not for funding questionable businesses like Fatty McGees Restaurant.

You want the 50000 car and have negotiated the price down to 45000. Business Cycle Dating Committee Announcement September 20 2010 US. After he received the house no events occurred to increase or decrease the basis.

Local benefits include the.

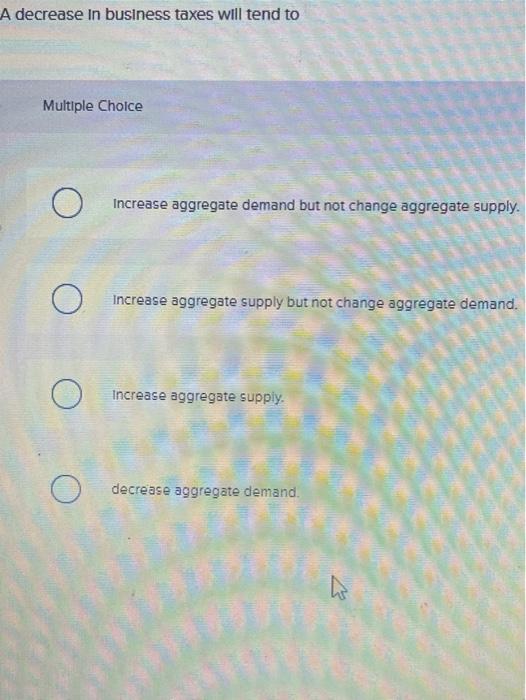

Solved A Decrease In Business Taxes Will Tend To Increase Chegg Com

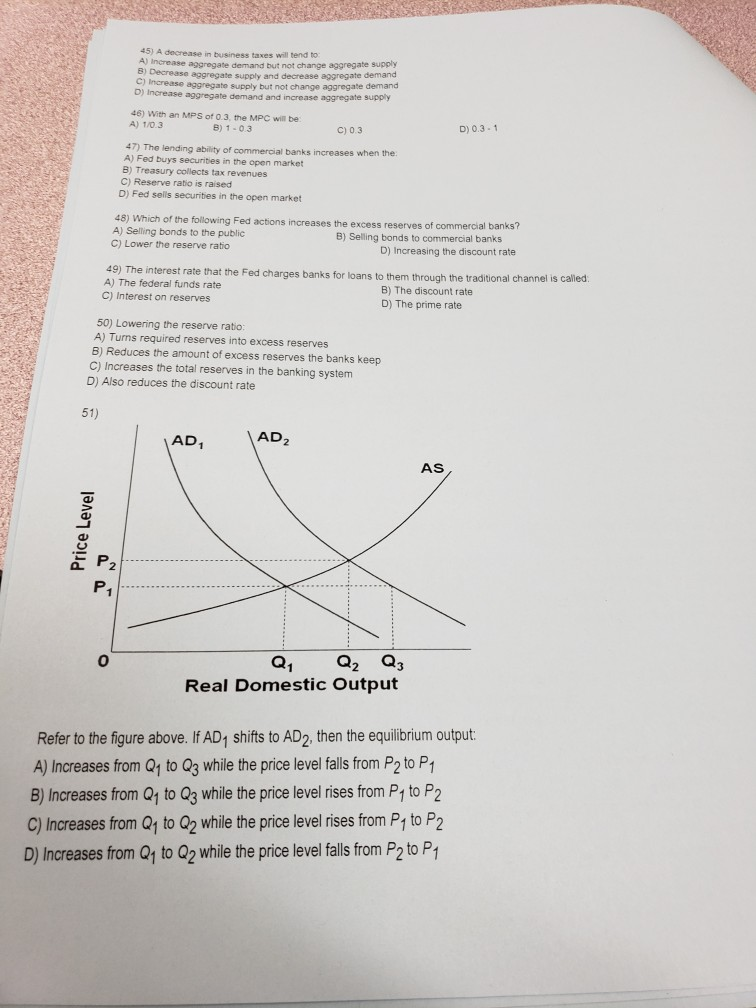

Solved 45 A Decrease In Business Taxes Will Tend To 8 Chegg Com

Solved A Decrease In Business Taxes Will Tend To Multiple Chegg Com

Solved A Decrease In Business Taxes Will Tend To Multiple Chegg Com

Comments

Post a Comment